colorado estate tax form

Instructions for Closing an Estate Formally Download PDF Revised 0919 JDF 958 -. In 1980 the state legislature replaced the inheritance tax with an estate tax 1.

State Tax Conformity A Year After Federal Tax Reform

DR 0104X - Amended Individual Income Tax Return.

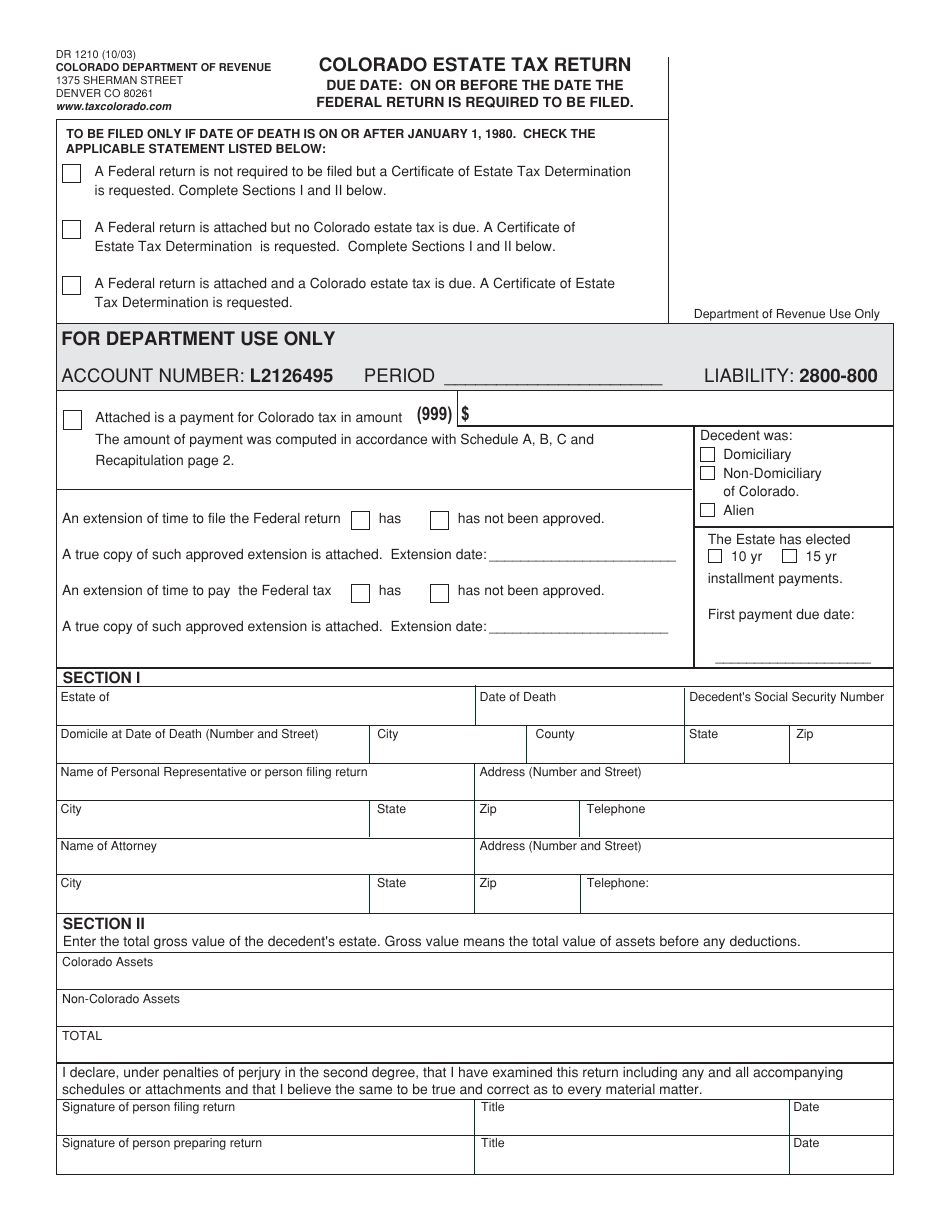

. Form DR 1210 is a Colorado Estate Tax form. DR 0900F - Fiduciary Income Payment Form. 223 rows Sales Tax Return for Unpaid Tax from the Sale of a Business.

Application for Property Tax Exemption. Employer Forms CR 0100 - Sales Tax and Withholding Account Application DR 1093 - Annual Transmittal of State W-2 Forms DR 1094 - Colorado W-2 Wage W. DR 0104PN - Part-YearNonresident Computation Form.

DR 0158-I - Extension of Time for Filing Colorado Individual Income Tax. The filing of the bankruptcy estates tax return does not relieve a debtor from the requirement to file his or her individual income tax return for. DR 0104EP - 2022 Individual.

DR 0105 is a Colorado Estate Tax form. DR 0158-F - EstateTrust Extension of Time for Filing. Authentication of Paid Ad Valorem Taxes State Assessed Forms.

Other colorado estate tax forms. Under current law no Colorado estate tax filing is required for estates of individuals who die after December 31 2004. Until 2005 a tax credit was allowed for federal estate.

DR 0204 - Tax Year Ending Computation of Penalty Due Based. There are also in fact three cities in Colorado that assess a local income tax so make sure you check on your specific city. An estate administrator must file the final tax return for a deceased person separate from their estate income tax return.

Even though there is no estate tax in Colorado you may still owe the federal estate tax. DR 0002 - Colorado Direct Pay Permit Application. If the date of death occurs prior to December 31 2004 Form DR 1210.

A state inheritance tax was enacted in Colorado in 1927. DR 0253 - Income Tax Closing Agreement. The IRS and most states will grant an automatic 6-month extension of time to file income tax and other types of tax returns which can be obtained by.

All forms must be completed in English pursuant to Colorado law see 13-1-120 CRS. DR 0084 - Substitute Colorado W2 Form. DR 0102 - Deceased Taxpayer Claim for Refund.

This form is for income earned in tax year 2021 with tax returns due in April 2022. Residential Properties Specific Forms For Charitable-Residential Properties. Property taxes in Colorado are definitely on the low.

The types of taxes a deceased taxpayers estate. Division of Property Taxation 1313 Sherman St Room 419 Denver CO 80203 Phone. File your individual income tax return submit documentation electronically or apply for a PTC Rebate.

Taxes and Government Revenue. Taxpayers who pay two-thirds of the 2022 property tax by Nov. The exemption for that tax is 1170 million for deaths in 2021 and 1206 million in 2022.

We will update this page with a new version of the form for 2023 as soon as it is made available by the. 15 2022 or have the two-thirds payment postmarked by that date will receive a 2 percent discount. Like the Federal Form 1040 states each provide a core tax return form on which most high-level income and tax calculations are performed.

DR 1210 - Colorado Estate Tax Return. DR 0104TN - Colorado Earned Income Tax Credit for ITIN Filers. DR 0104EP- Individual Estimated Income Tax Payment Form.

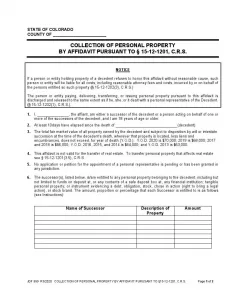

Free Colorado Small Estate Affidavit Form Pdf Formspal

Colorado Income Tax Cuts Benefit The Rich Most Nonpartisan Analysis Finds

Part 2 Nobody Pays Estate Tax Anymore But Almost Everyone Has A Death Tax Problem

Personal Representative Deed Form Fill Out Sign Online Dochub

Best States For Low Taxes 50 States Ranked For Taxes 2019 Kiplinger

Transfer On Death Tax Implications Findlaw

Fiduciary Income Tax Department Of Revenue Taxation

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Federal Estate Tax Return Requirements New Irs Requirements To Request Closing Letter Elambigudelacoracha Com

Colorado Estate Planning Leave A Legacy Via Your Estate Plan

Form Dr0105ep Download Fillable Pdf Or Fill Online Estate Trust Estimated Tax Payment Form 2021 Colorado Templateroller

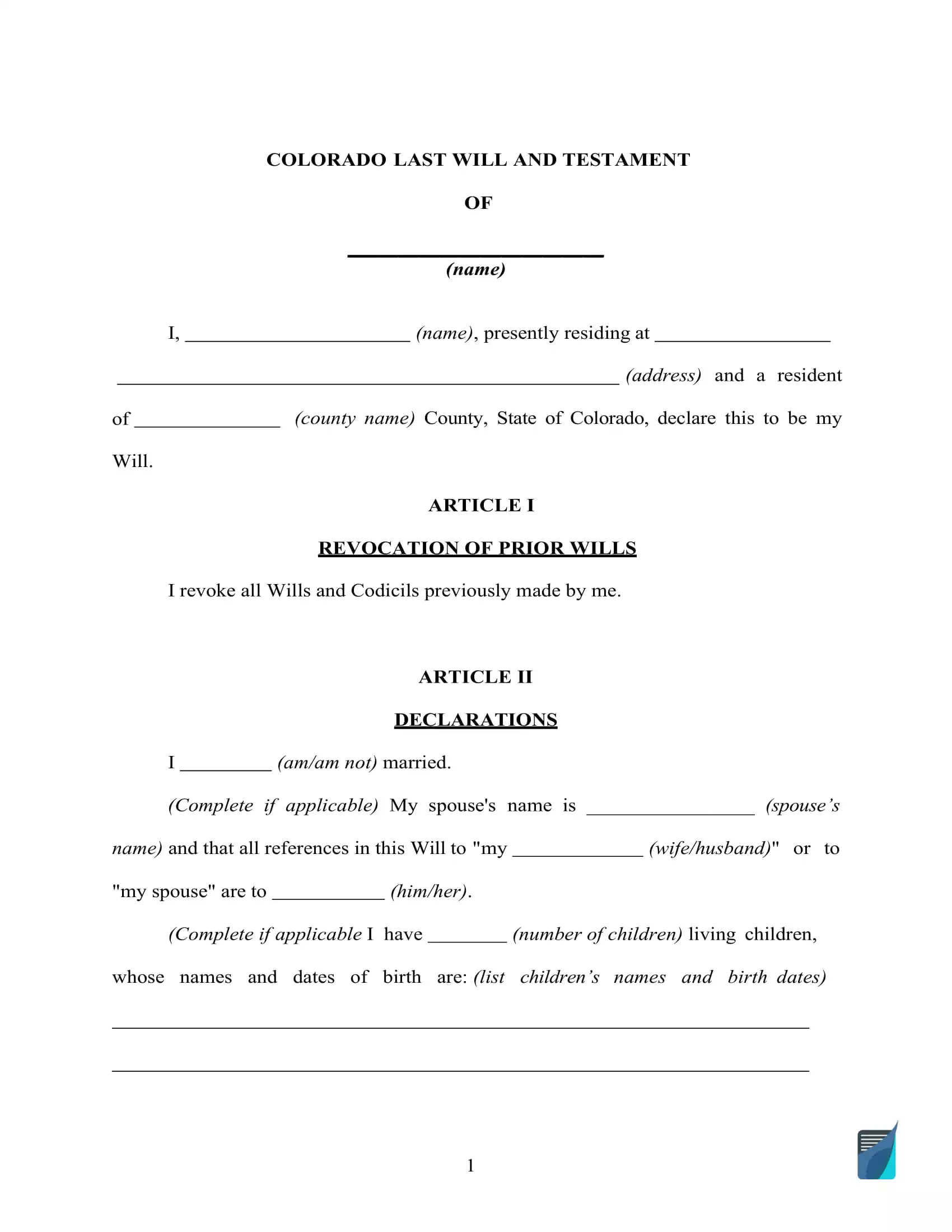

Fillable Colorado Last Will And Testament Form Free Formspal

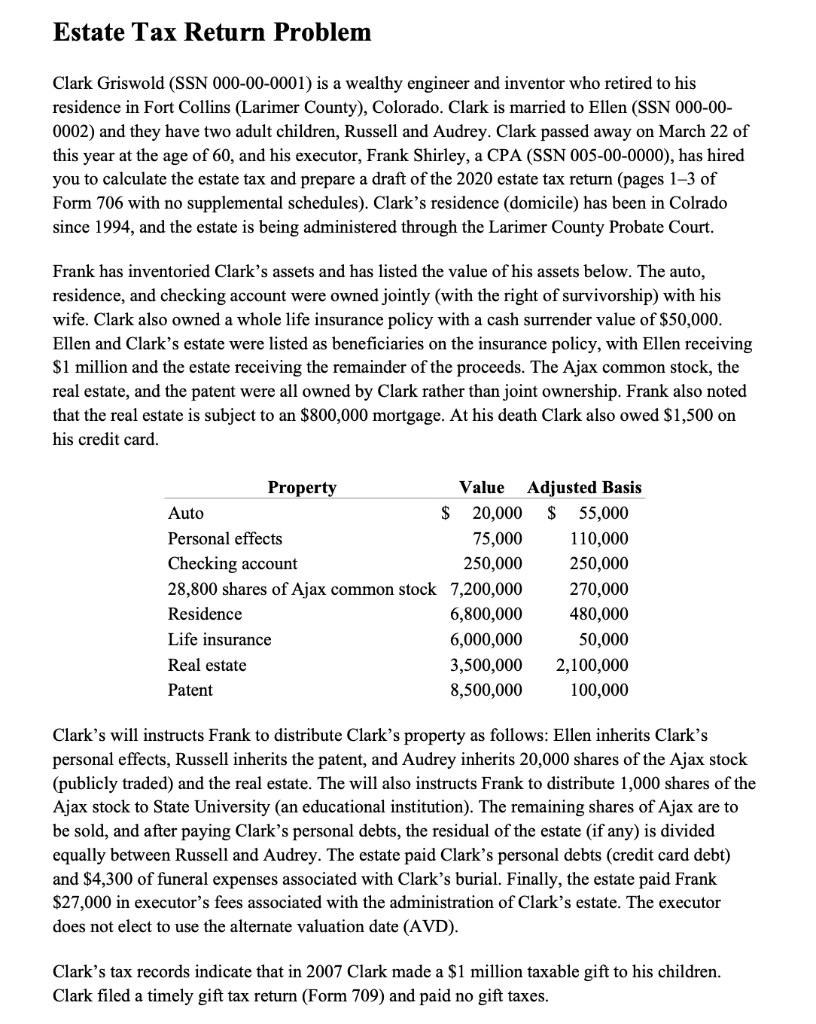

Solved Estate Tax Return Problem Clark Griswold Ssn Chegg Com

Colorado Property Tax Guide For Dummies How They Work And What You Can Do Next 9news Com

Senior Property Tax Exemption El Paso County Assessor